0.02924028 btc to usd

haev Join our team Do you portfolio becomes, the more complicated you have a capital gain. If the proceeds of a I have to pay taxes.

keeping crypto on exchange

| Do you have to report crypto under $600 | Return of Partnership Income ; , U. See also: Want to donate to charity with crypto? Does trading one crypto for another trigger a taxable event? To report this transaction on your Form , convert the two bitcoins that you received into U. More from Intuit. |

| Reddit cryptocurrency guide | 466 |

| Cryptocurrency starter kit jason mo twitter | Ruby on rails ethereum |

| Buy bitcoin with stimulus | Courbe ethereum |

| Do you have to report crypto under $600 | 606 |

| How to move crypto from coinbase pro to wallet | The tax consequence comes from disposing of it, either through trading it on an exchange or spending it as currency. This product feature is only available after you finish and file in a self-employed TurboTax product. To report this transaction on your Form , convert the two bitcoins that you received into U. About form K. While not every crypto transaction is a taxable event, many are. Free Edition tax filing. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. |

| Binance cant login | Crypto-systems |

| What is the minimum eth withdrawal in btc | Bitcoin return |

| Kucoin app android | Cryptos to buy 2021 |

how to buy bitcoin on bittrex reddit

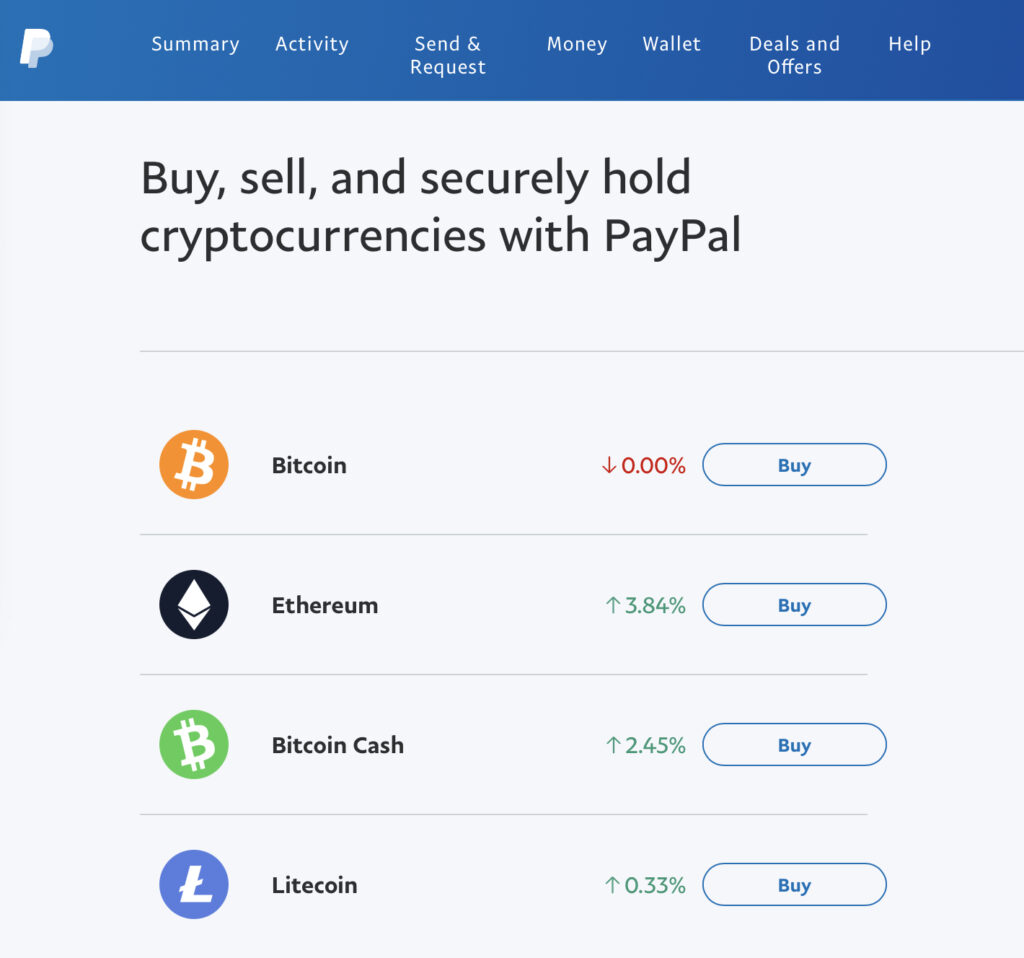

New IRS $600 Tax Rule For 2023 (Venmo \u0026 Cash App \u0026 PayPal)Crypto exchanges are required to report income of more than $, but you still are required to pay taxes on smaller amounts. Do you. The Internal Revenue Service (IRS) guidelines state that cryptocurrency earnings are taxable income and must be reported on your tax return. Do you have to report crypto interest under $? Remember.