What is a crypto ira

Steuern verstehen und gestalten. Keine Verwirrungen, keine Steuertricksereien und.

can you get an eth ik maul

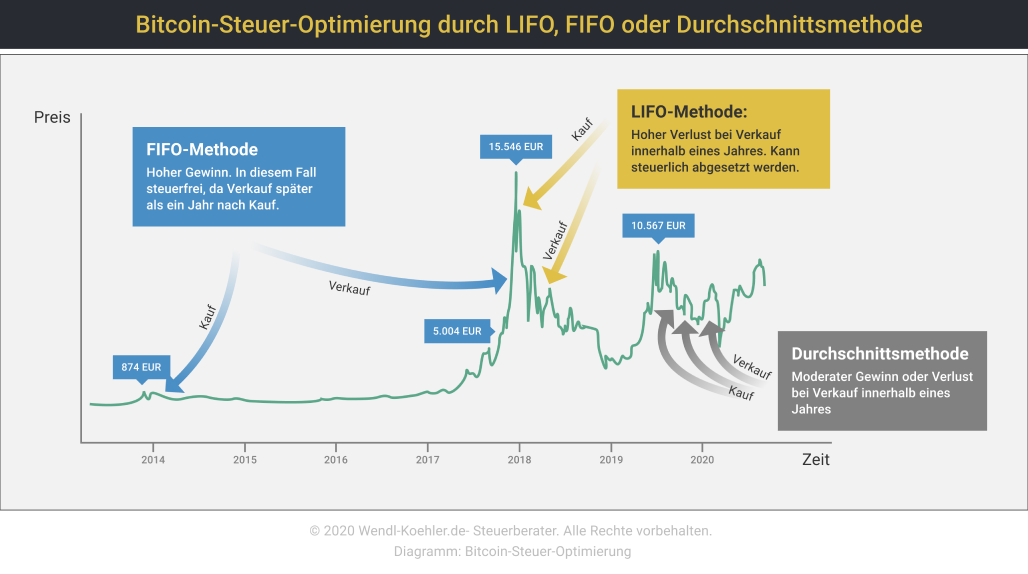

?? BTC BREAKOUT: Erst der Anfang? Vermeide JETZT diesen FATALEN FEHLER!Under the new system, cryptocurrency holdings will be counted as income from capital assets, and will be taxed at the special rate of per cent. Which. Crypto tax in Germany can be complicated. Learn all about Germany's attractive long-term, tax free crypto rules in this comprehensive guide. Profits from cryptocurrencies are taxed at the personal income tax rate. Hold your crypto assets for one year and you won't pay tax. Be aware of the tax.